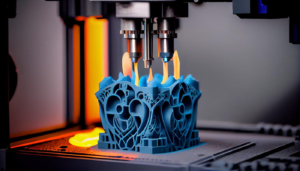

3D Printing, also known as additive manufacturing, is becoming an integral part of every industry. From schools to construction, companies are using the technology to create prototypes and end-use parts quickly and cheaply.

This futuristic printing method allows for more iteration and experimentation and teaches valuable skills like design, modeling, and problem-solving. It can produce a wide range of materials, from plastics to metals. Contact By3Design now!

3D Printing is a more cost-effective option than conventional manufacturing methods, particularly for short production runs. While traditional prototyping methods like CNC machining and injection molding require expensive machines and higher labor costs, 3D Printing uses only 1 machine with lower operating and maintenance costs. It also requires less material than subtractive manufacturing processes, so there is significantly less waste produced.

Another significant advantage of 3D Printing is that it reduces inventory and shipping costs. This is because manufacturers can produce parts on demand, enabling companies to adopt just-in-time and on-demand manufacturing systems. With these systems, the company only needs to store a small amount of parts in stock and can quickly produce additional units if necessary. This is also known as digital warehousing and is a major trend in manufacturing that has been enabled by 3D Printing.

Using 3D Printing can also eliminate the need for redesign cycles and help reduce production costs by minimizing the number of iterations. In addition, design engineers can work with digital models that can be reworked quickly and easily. This can save time and money, as well as avoid costly mistakes and rework.

Costs can be reduced further by sourcing low-cost raw materials and using open-source slicing software. For larger projects, consider purchasing materials in bulk to get better volume discounts and reduce shipping costs. The cost of the 3D printer and material will also influence your overall costs. However, it is important to remember that a model’s complexity can impact the number of print failures and the density of the material used, which will affect pricing.

One of the key benefits of 3D Printing is its ability to create complex geometries that cannot be manufactured with other manufacturing techniques. This allows for the consolidation of multiple components into a single part, which reduces costs and saves engineering time. It also helps manufacturers produce lighter products by creating internal voids, which reduces the weight of the finished product.

3D Printing also makes it possible to create jigs and molds that are used during production, allowing businesses to streamline repair and maintenance costs by removing the need for external suppliers. This can save time and money and also improve customer service by eliminating delays caused by supply chain issues.

Time-Saving

3D Printing can save businesses time and money by eliminating the need for prototypes and production. It also eliminates the need for expensive tools and materials. In addition, it speeds up the product development cycle. This helps reduce the number of iterations needed to perfect a design and increase profitability.

The printing process is generally the same as an inkjet printer, and consists of creating layers of plastic or carbon fiber material on top of one another. The layers are then heated to harden and fused together. This allows for more precise and accurate Printing, resulting in higher quality products.

In addition, 3D Printing provides greater design freedom. It can be used to create complex geometries and consolidate parts that would have been made separately into a single part. This can greatly reduce assembly and maintenance costs, as well as the amount of waste produced by traditional manufacturing processes.

For example, in construction, 3D Printing can replace formwork. This can help reduce the cost and weight of concrete structures by reducing the need for forming and curing. Additionally, it can reduce the amount of raw material required for construction by using recycled materials.

Moreover, 3D Printing can be used to create models of patients’ anatomy for surgical planning and medical training. This technology could lead to new treatment methods and cures for diseases. It can also be used for education, and students can use it to make models of their own anatomy and physiology.

While 3D Printing offers several advantages, there are some disadvantages as well. For instance, the printing process can be slow and time-consuming. However, there are ways to speed up the process without sacrificing print quality. Several hardware and software adjustments can be made to reduce print times. These techniques can be applied to both consumer and industrial-grade printers.

Another disadvantage of 3D Printing is the risk of counterfeiting and copyright infringement. Since it is so easy to create copies of original designs, people are increasingly tempted to copy and sell them. However, there are ways to prevent this from happening.

Environmentally Friendly

3D Printing allows for a much lower environmental footprint than traditional manufacturing methods. Conventional processes involve cutting, drilling and shaping raw materials into the desired product, which results in a lot of production waste. In comparison, 3D Printing only uses the necessary amount of material to create the final product, which reduces waste by as much as 90%. This decrease in raw material use also translates into less waste from sourcing, transportation, and disposal.

Aside from the reduction in production waste, 3D Printing can help reduce the environmental impact of traditional manufacturing processes by reducing energy consumption. Although this may not be a significant factor at current scale, it could make an important difference over time as the technology is adopted. One way to reduce the energy demand of 3D printers is to use sustainable filaments made from recycled plastics. This helps to reduce the demand for new plastics and prevents waste from ending up in landfills.

Another important benefit of 3D Printing is that it can be used to produce products locally, which reduces the need for transportation and packaging. This can help to cut down on the carbon emissions produced by industrial factories and warehouses. In addition, it can be used to produce spare parts for local companies or individuals, which can eliminate the need for a large inventory of stock. This approach can also be used to assist disaster-stricken areas in efficiently rebuilding their infrastructure.

Although 3D Printing does not cause a lot of pollution, the process does generate some volatile organic compounds (VOCs). These VOCs can be caused by the choice of materials, temperature of machinery, filament color, and printer model. However, if these chemicals are properly disposed of, they will not pose any harm to the environment.

The good news is that the majority of VOCs are emitted during the sintering process, which can be reduced by using materials with a low melting point. In addition, the use of sustainable smart technology can help to reduce the overall energy consumption of 3D Printing.

Customizable

In a world of mass-market consumerism, consumers are increasingly interested in products that are uniquely their own. This trend is known as “mass customization.” With 3D Printing, manufacturers can produce customized goods in large quantities without increasing operational costs or delivery timelines. This can help businesses establish a stronger relationship with consumers and boost customer loyalty.

3D Printing, also called additive manufacturing, is the process of creating three-dimensional objects from a computer-aided design (CAD) model through a layering method. The technology is ideally suited for rapid prototyping, which allows manufacturers to quickly test a product and improve its quality before investing in production. This can significantly reduce development time and the risk of costly errors that may occur during normal production.

This method of manufacturing can also be used for the production of end-use parts. GE Aviation, for example, uses 3D Printing to make customized nozzle tips for LEAP jet engines. These bespoke components provide better performance, lower maintenance costs, and improved fuel efficiency.

Another advantage of 3D Printing is its ability to produce complex shapes that would be difficult or impossible to manufacture through conventional methods. The process can create intricate geometries, lattices, and internal cavities that are essential for certain applications, such as medical devices. It can even produce models of organs and bones for surgical planning and training.

The versatility of 3D Printing offers a wide range of opportunities for businesses to expand their customer base and develop a stronger brand identity. The technology can be used to create a variety of unique products and services, including personalized gifts and home decor. It can also be used to make prototypes for industrial design and engineering projects. It can be an effective way to teach students the skills necessary for a career in engineering and design.

In addition to its cost-effective and environmentally friendly advantages, 3D Printing has the potential to revolutionize the retail industry by enabling businesses to make customized items on demand. The ability to quickly fabricate a custom product based on the consumer’s specifications will help retailers maintain a consistent supply chain and reduce inventory and shipping costs. The resulting low production costs can lead to greater profit margins and reduced risk of supply chain disruption.